federal unemployment tax refund for married filing jointly

If you have federal tax withholding and. You can e-file IL it is a stand alone state and does not require the federal return for filing see here.

Filing Status 2021 Married Filing Separately Filing Taxes Status

The lowest rate is 10 for.

. Because the tax brackets for married filing jointly are broader youre likely to be taxed at a lower rate on these earnings than if you were single. The IRS is issuing another 15 million refunds to workers who paid federal income taxes on their unemployment benefits they received. But if youre married filing separately you wont be eligible.

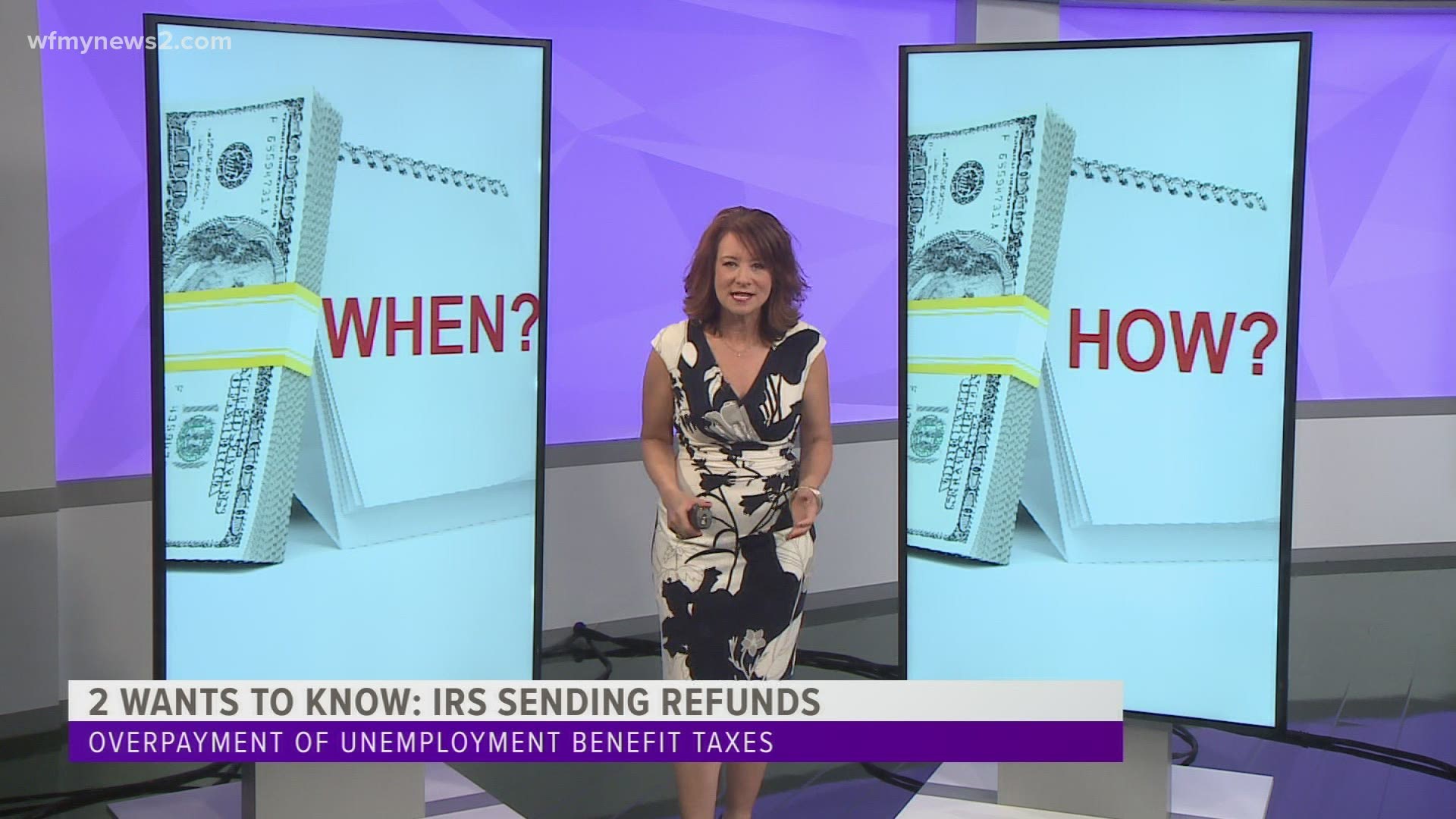

Federal tax refunds going out to taxpayers who paid taxes on 2020 unemployment benefits. The IRS will start issuing unemployment tax refunds in May. Married couples who file a joint return must generally wait until phase two according to.

64 votes 145 comments. The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits collected last year. The American Rescue Plan forgave taxes on the first 10200 of unemployment for individuals including those who are married but file taxes separately.

The American Rescue Plan allowed taxpayers to waive up to 10200 of paid unemployment. Federal tax return as Married filing jointly and state tax as Married filing separate. The tax benefit applies per person meaning a married couple can exclude a maximum.

In some cases when Form 1099-G Certain Government Payments information was not available the IRS automatically allowed an exclusion amount of up to 20400 for married individuals who live in a non-community property state and who filed a joint 2020 tax return when. The legislation exempted 10200 in benefits for taxpayers for last year with an income of up to 150000. 12 for incomes over 9950 19900 for married couples filing jointly.

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers. The legislation excludes only 2020 unemployment benefits from taxes. While married couples filing jointly could exclude up to 20400 of unemployment benefits from their earnings.

Beginning in 2022 you would file married filing jointly. The rules further state Please note that a joint return isnt allowed if both you and your spouse werent Massachusetts residents for the same portion of 2021 Based on the rules for Massachusetts your wife would file married filing separately for tax year 2021. Just wish the IRS could be more specific than just sending refunds through the summer Filed in Jan accepted Feb 13th received initial refund in March.

Virginias income tax is imposed at graduated rates starting at 2 and capping at 575. Anything below 19900 means you pay a 10 tax rate. We cant overstate this.

The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. Has anyone else who Filed Married Jointly with dependents received any info on their Unemployment Tax waiver refund. While nearly 90 percent of all checks have been sent out so far it hasnt been nearly as smooth sailing for the refunds from the 2020 unemployment benefits which are from the waiving of federal tax on up to 10200 of jobless claimsor 20400 for married couples filing jointlythat were received by taxpayers in 2020.

You can get these credits if your filing status is married filing jointly single or head of household. Unemployment tax refund no dépend single filer who is still waiting on his refund. If you and your spouse file a joint return and your joint modified AGI is less than 150000 you should exclude up to 10200 of your unemployment compensation and up to 10200 of your spouses unemployment compensation.

It forgives 20400 for couples filing jointly. Report Inappropriate Content. The highest rate applies to income over 17000.

When a married couple chooses to file a joint return Filing Status 2 they report their income together in the same column on the return. The lowest rate is 10 for incomes of single individuals with incomes of 9950 or less 19900 for married couples filing jointly. Federal Tax Refund E-File Status Question.

When you file jointly you only have to fill out one tax returnnot two. For example the 28-percent marginal rate for single filers begins at 83601 in 2011 while married couples arent taxed at that rate until their income reaches 139351. IL filing status rules are here.

The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. You can file MFS using your MFJ federal return with amounts allocated between you. On my taxes i filed married filing jointly but i was the.

While married couples filing jointly could exclude up to 20400 of unemployment benefits from their earnings. These potentially generous payments are from the waiving of federal tax on up to 10200 of unemployment benefitsor 20400 for married couples filing jointlythat were collected last year. Keep checking my Transcript and I need to quit.

You can save time. The total unemployment compensation was 10201 or more. While nearly 90 percent of all checks have been sent out so far it hasnt been nearly as smooth sailing for the refunds from the 2020 unemployment benefits which are from the waiving of federal tax on up to 10200 of jobless claimsor 20400 for married couples filing jointlythat were received by taxpayers in 2020.

The first 17000 of their total taxable income is then taxed at. Unemployment tax refund. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse.

For married couples filing jointly 20400 in benefits are exempted. If you file Form 1040-NR or file Form 1040 or 1040-SR separately from your spouse you generally dont report your spouses. It will do so in two phases.

22 for incomes over 40525 81050 for married couples filing jointly. Now just to be clear. Posted by 4 months ago.

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

10 200 Unemployment Tax Break When Married Couples Should File Separately

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Are You To Blame For Delay In Unemployment Tax Refunds The National Interest

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Irs Continues Unemployment Compensation Adjustments Prepares Another 1 5 Million Refunds The Southern Maryland Chronicle

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Com

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits